home loans st louis mo guide for buyers and homeowners

What to know before you shop

In St. Louis, neighborhoods vary widely-from brick-lined streets in Tower Grove to suburbs like Kirkwood-so your loan needs should reflect price ranges, taxes, and commute priorities. Start with a fully underwritten preapproval to compete in tight blocks, and check property condition if you’re eyeing historic homes.

Popular loan options

Local borrowers mix conventional and government-backed choices depending on credit, down payment, and home price. Missouri programs may offer down payment help to qualified buyers.

- Conventional: flexible terms, good for strong credit.

- FHA: lower down payment; useful for first-time buyers.

- VA: zero down for eligible veterans around Scott AFB and the metro.

- USDA: for select outskirts; verify eligibility by address.

Rates, fees, and timing

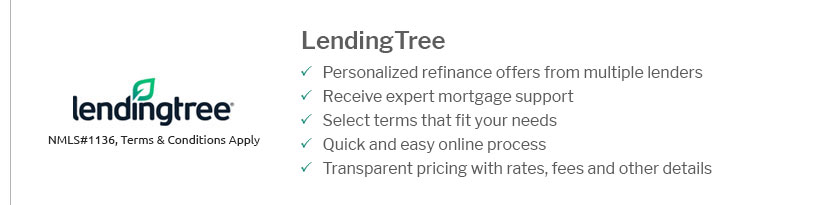

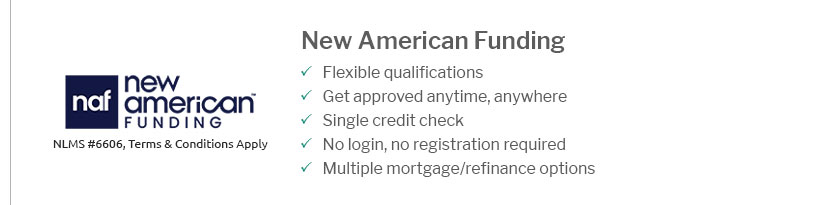

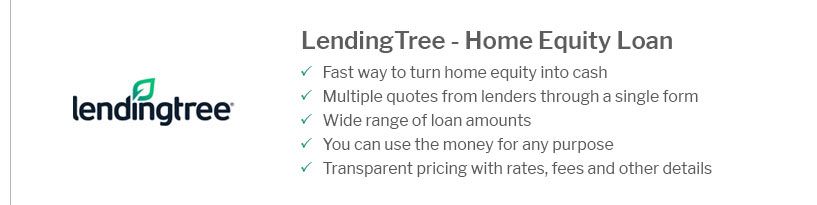

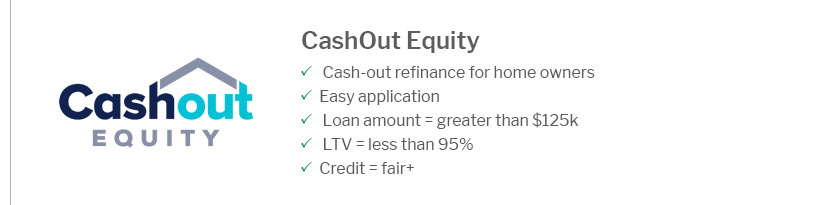

Compare APRs across at least three lenders, and ask for lender credits versus points. Typical closing takes 30–45 days; align your rate lock with inspection periods and the seller’s timeline. Budget for city occupancy requirements and homeowners insurance, especially near river-adjacent areas. A seasoned local loan officer can map options to your budget and long-term plans.